- Best personal budget app for ipad 2012 registration#

- Best personal budget app for ipad 2012 software#

- Best personal budget app for ipad 2012 trial#

- Best personal budget app for ipad 2012 free#

Our team evaluated several budgeting apps before choosing the best options for our readers.

Best personal budget app for ipad 2012 software#

Accounting software typically costs more and has a steeper learning curve while basic budgeting apps can be mastered in minutes.

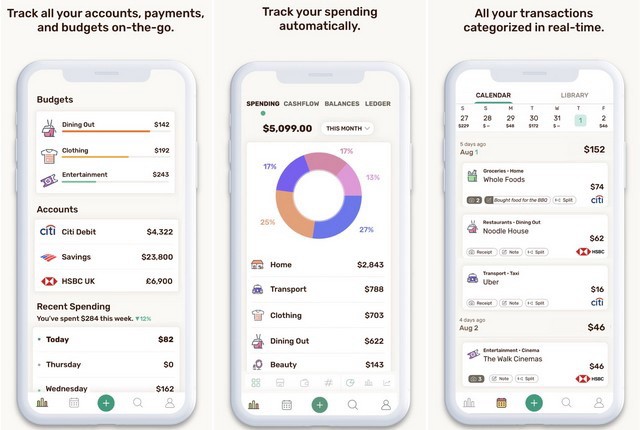

Accounting programs often offer more robust features designed for finances above and beyond the typical household-they're often used for business bookkeeping. Consider setting up savings goals, if possible.įrom there, you can explore the rest of the app’s features to see what it has to offer-look for handy tools like bill alerts and subscription tracking, and advice for making and sticking to a budget.īudgeting apps are accessed through an online platform, or downloaded on your mobile phone or tablet to be used on the go, but not all accounting software has this option. You may be able to set transaction categories, or the app may do that for you if so, check the categories to make sure they’re accurate. You’ll typically be asked to provide your income, and to sync up your bank accounts, credit cards, debit cards, loans, and other financial accounts.

Best personal budget app for ipad 2012 registration#

Depending on the app, registration may only require an email address.Īfter logging in, you may find step-by-step instructions to get started. Start by visiting the company website or downloading the app, and then create a new account. Signing up for budgeting apps is usually quite easy. User reviews: Check the reviews of budgeting apps on the App Store and Google Play for insight from actual users.

Best personal budget app for ipad 2012 free#

Can the app tell the difference automatically? If not, can you categorize transactions yourself? This is one of the most useful aspects of budgeting apps.

Best personal budget app for ipad 2012 trial#

Price: Some excellent budgeting apps are free, while others offer a free trial period or have monthly or annual fees.Consider the following when choosing a budgeting app: Manage spending and plan for monthly billsĮvery budgeting app aims to help you track spending and save money, but they come with a variety of features.You might need a budgeting app to help you: All that would be difficult or impossible to replicate on your own, but budgeting apps make it easy. Many apps generate reports to show how your finances change over time. They can automatically sync up with all of your bank accounts and payment cards, categorize your transactions, and give you a bird’s-eye view of what you buy and how much you spend each month. Guide to Choosing the Best Budgeting App Determine Your Need for a Budgeting Appīudgeting apps take a lot of the work out of making and maintaining a budget. You Need a Budget Best for Type-A Personalitiesīudgeting tool is free 0.89% for first $1,000,000 invested PocketGuard Best to Keep From Overspendingįree basic version PocketGuard Pro: $7.99 per month

0 kommentar(er)

0 kommentar(er)